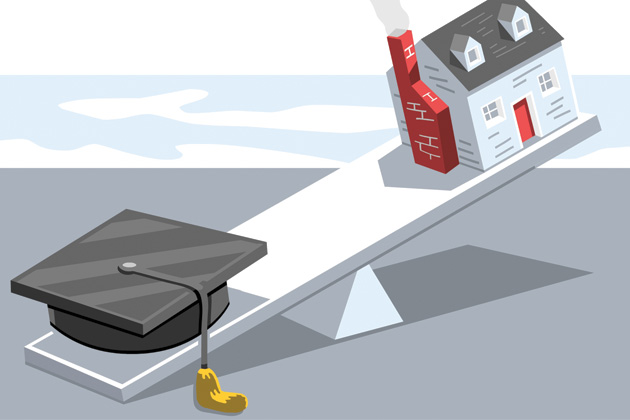

On a study made on various debt forms, families are discovered more strained in reimbursing their home debt. Home credit issues are found in all houses. In any case, subsequent to the issues are basic in all area of individuals; there are answers for everybody also. That is, there are same sorts of home credits accessible for everybody, except the rate of interest relies on upon your salary and the property you are purchasing. The land help and individuals needing to live in better zones with better facilities prompted an expansion in the different home credit arrangements.

Have a well formed outline

Making a solid money related arrangement may help you to avoid falling under water. It resembles giving an outline to you. The reasonable objectives in you may help in paying off the obligations that you may go over all of a sudden. Put something aside for the future and set yourself an objective to lessen the abundance installment on the off chance that you are in the red. An appropriate spending plan may help you to achieve this outline. The colossal increment in expense of house furniture and imperative different costs is basically required for the procuring individuals. Save from your normal income and a piece of reserve funds.

Amalgamate your advances

In the event that you are right now overwhelmed by obligation and have no simple contrasting option to pay them back,the main route is to merge your advances. This will make the administration less demanding. This will likewise help you to know the careful sum, as in the amount you are paying for your obligation. Solidification of debts brings down the amount. It is more valuable and accommodating in putting something aside for the future reimbursement also. Solidification additionally sets in with a lower financing cost and consequently, this will bring down your aggregate spending plan. The loan fee continues changing and this will likewise be beneficial for your reimbursement. Learn more about the topic and also on prosper loans by checking out online.

Have a crisis individual

To proceed with combination, the individual whose help you will need is the direction of a specialist. He may propose you with the diverse plans and timetables that have been managed. These directions are regularly recipient as they may lead you to help in reimbursing a lesser sum. The specialists know about the rates that can be forced on the aggregate sum of obligation. This will likewise help you to make a comprehension about the aggregate sum you have to put something aside for your result. Uniting specialists may help you in sidestepping few home obligations as there are such opportunity. Home obligations started off interest free and have low rates as compared to other mortgages.

Pick an approved firm

Make a point to work with governmentally authorized firms to look after authenticity. When you are sharing your obligation issues to any organizations, you are really giving them your budgetary points of interest. For this situation you should know about their legitimate field. This will just help you in achieving your money related objectives. Home obligations are to such an extent that regularly make individuals discouraged from inside and this can be maintained a strategic distance from on the off chance that you basically have a real and authorized organization to help you in dealing with your obligations.